The Four-Component STR Empire Formula

(You Only Need One)

Table of Contents

Why "Well-Rounded" STR Operators Always Fail

The Knowledge Component: Why Experts Eat First

The Time Component: How Sweat Equity Beats Smart Money

The Money Component: Why Capital Without Knowledge is Dangerous

The Credit Component: The Leverage Multiplier Nobody Understands

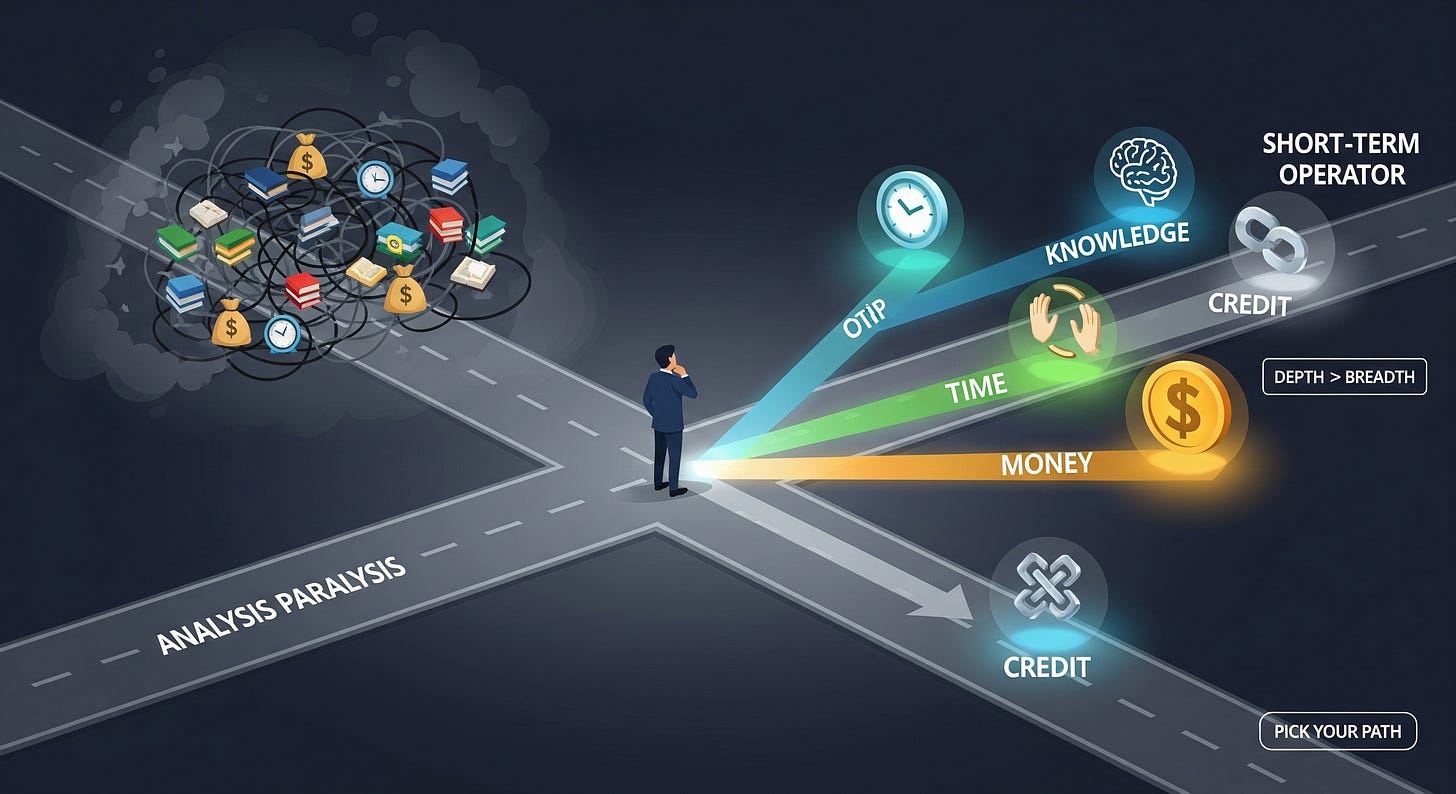

Every successful STR empire was built on mastering exactly ONE of these four components. Which one are you ignoring?

Here's what the gurus won't tell you: the fastest way to fail in STR is trying to be good at everything. While you're spinning your wheels trying to master knowledge AND save money AND build credit AND invest time equally, your competition is dominating markets by going deep on their strongest component.

Today, I'm going to show you the four-component formula that built every major STR empire - and why your obsession with being "well-rounded" is the exact thing keeping you from $800+ per bedroom performance.

But first, let me tell you about the business credit solution that's helping our students focus on their strengths instead of their financial limitations...

Sponsored by Fund & Grow

Speaking of capital challenges - I've been working with Fund & Grow for 4-6+ years because they solve the #1 problem new STR operators face: access to business credit. We've helped our students secure $200K+ in business credit, even when they're brand new to STR.

Unlike traditional lenders who want perfect credit and 2 years of tax returns, Fund & Grow specializes in getting business credit for operators who need capital NOW, not someday. This lets you focus on your strongest component - whether that's knowledge, time, or execution - while they handle the credit component for you.

Why "Well-Rounded" STR Operators Always Fail

The biggest lie in business education is that you need to be good at everything. In STR, this lie is financially devastating.

The Jobs to be Done Framework reveals why: when you hire generalization to avoid specialization, you simultaneously hire mediocrity. The marketplace doesn't reward jack-of-all-trades operators - it rewards masters who dominate their component and partner for everything else.

Design Thinking teaches us to focus on solving specific problems exceptionally well rather than solving many problems poorly. STR empires aren't built by operators who are "pretty good" at everything - they're built by operators who are exceptional at one thing.

According to research from Harvard Business School, specialists earn 23% more than generalists and show significantly higher success rates in competitive markets, proving that depth beats breadth in value creation.

Here's the STR reality that destroys most operators:

Knowledge + Time + Money + Credit = Paralysis

When you try to master all four components simultaneously, you create analysis paralysis that prevents action. You spend months "getting ready" in all areas instead of dominating one area and taking action.

Meanwhile, successful STR operators identify their strongest component and build their entire business model around that strength:

Knowledge operators become the experts everyone wants to hire

Time operators build sweat equity that compounds exponentially

Money operators deploy capital strategically for maximum returns

Credit operators leverage other people's money to scale rapidly

The marketplace rewards specialization, not generalization. Your competition isn't trying to be good at everything - they're trying to be the best at one thing.

Your Quick Win: Identify which of the four components (Knowledge, Time, Money, Credit) is your strongest - focus there for 30 days and ignore the others completely.

The Knowledge Component: Why Experts Eat First

In a world where everyone has access to capital, knowledge is the ultimate differentiator - and the ultimate profit multiplier.

The Jobs to be Done Framework shows us that people hire expertise to shortcut their learning curve and avoid expensive mistakes. When you become the STR knowledge expert in your market, you're not just running properties - you're being hired to solve everyone else's problems.

Design Thinking reveals that true expertise comes from understanding what guests actually value versus what operators think they want. Knowledge operators develop empathy through systematic learning rather than random experience.

As Amazon founder Jeff Bezos explained:

"I knew that if I failed I wouldn't regret that, but I knew the one thing I might regret is not trying."

But here's what Bezos didn't mention: knowledge without action is worthless. Knowledge operators don't just consume information - they systematically apply it and measure results.

Research from McKinsey & Company shows that knowledge-intensive businesses generate 40% higher profit margins than asset-intensive businesses, proving that expertise commands premium pricing.

Here's how knowledge operators dominate STR markets:

Systematic Learning Approach:

Study guest behavior data, not just industry opinions

Master revenue optimization techniques that others guess at

Understand market dynamics that drive pricing power

Develop operational systems that scale without proportional cost increases

Market Positioning Advantages:

Command consulting fees that exceed property income

Attract partnership opportunities with capital providers

Build referral networks that generate off-market deals

Create information products that provide passive income streams

Competitive Moats:

Solve problems that money alone can't fix

Provide insights that time-rich but knowledge-poor operators desperately need

Build reputation that attracts both guests and business opportunities

Develop frameworks that can be licensed to other markets

The knowledge component is the only one that appreciates over time. While properties depreciate and money inflates, expertise compounds.

Your Quick Win: Choose one STR knowledge area and consume 3 pieces of content about it today. Focus on implementation, not just information consumption.

Want to become the expert in your market?

The Time Component: How Sweat Equity Beats Smart Money

While money operators are writing checks, time operators are building equity that can't be bought at any price.

The Jobs to be Done Framework reveals that time operators hire personal effort to understand every detail of their business in ways that outsourcing never teaches. This deep understanding creates competitive advantages that money can't replicate.

Design Thinking shows us that hands-on experience provides insights that theoretical knowledge or delegated management can't provide. Time operators develop empathy for guest experiences through direct involvement in every aspect of operations.

According to research from the Small Business Administration, businesses where owners invest significant personal time show 67% higher survival rates than those relying primarily on hired management, proving that sweat equity creates resilience.

Here's what time operators understand that others miss:

Operational Excellence Through Direct Experience:

Learn what actually matters for guest satisfaction versus industry assumptions

Develop problem-solving skills that can't be outsourced

Build relationships with vendors, guests, and partners through personal involvement

Create systems based on real experience rather than theoretical frameworks

Cost Structure Advantages:

Eliminate management fees that eat into profit margins

Identify inefficiencies that hired help might overlook or ignore

Develop maintenance skills that reduce operational expenses

Build guest relationships that drive repeat bookings and referrals

Scaling Foundations:

Understand every aspect of operations before delegating

Train employees based on personal experience rather than industry standards

Identify which tasks truly require expertise versus which can be systematized

Build procedures that actually work rather than look good on paper

Market Intelligence:

Develop direct guest feedback loops that inform business decisions

Understand seasonal patterns through personal observation

Identify market opportunities through hands-on experience

Build competitive intelligence through active market participation

Your Quick Win: Spend 2 hours this week doing something in your STR business you normally outsource. The insights you gain will pay dividends for years.

The Money Component: Why Capital Without Knowledge is Dangerous

Money is a powerful component - but only when deployed by operators who understand how to multiply it rather than just spend it.

The Jobs to be Done Framework shows us that money operators hire capital to accelerate proven systems, not to replace the need for systems. Capital without competence creates expensive mistakes, not competitive advantages.

Design Thinking teaches us that money operators must test with adequate resources versus being constrained by resources, but this testing must be systematic and measurable rather than random and hopeful.

As Warren Buffett famously observed:

"Risk comes from not knowing what you're doing."

This principle is especially critical in STR, where capital deployment decisions compound over time. Money operators who understand this principle build empires. Those who don't build expensive mistakes.

Research from Harvard Business Review indicates that companies with disciplined capital allocation strategies generate 2.1x higher returns than those without systematic approaches, proving that capital deployment strategy matters more than capital availability.

Here's how successful money operators deploy capital in STR:

Strategic Capital Deployment:

Invest in properties with proven demand rather than hoping to create demand

Deploy capital to solve known problems rather than prevent unknown problems

Use money to scale successful systems rather than experiment with unproven concepts

Invest in capabilities that create lasting competitive advantages

Risk Management Through Diversification:

Spread capital across multiple properties to reduce concentration risk

Invest in different markets to capture various seasonal patterns

Balance high-cash-flow properties with appreciation-focused properties

Maintain liquidity reserves for opportunity capture

Return Optimization:

Focus on properties that generate immediate positive cash flow

Invest in improvements that directly increase bookable value

Deploy capital to capture market inefficiencies rather than chase market averages

Use leveraged returns to accelerate portfolio growth

Exit Strategy Planning:

Build properties that attract other investors for eventual sale

Create operating systems that transfer to new owners

Develop market positions that appreciate independent of individual property performance

Maintain flexibility for market cycle timing

Your Quick Win: Before spending any money this week, write down exactly what result you expect and how you'll measure success. This simple discipline separates money operators from money wasters.

Ready to deploy capital like a pro?

The Credit Component: The Leverage Multiplier Nobody Understands

Credit isn't just about borrowing money - it's about multiplying your strongest component through other people's resources.

The Jobs to be Done Framework reveals that credit operators hire leverage to multiply existing capabilities rather than replace missing capabilities. Credit amplifies what you already do well; it doesn't fix what you do poorly.

Design Thinking shows us that credit operators must understand the psychology of lenders and partners, developing empathy for what makes other people willing to invest their resources in your vision.

According to research from the Federal Reserve Bank of St. Louis, leveraged businesses show 3.2x higher growth rates than unleveraged businesses when properly managed, proving that strategic leverage creates exponential advantages.

Here's what separates credit operators from people who just borrow money:

Strategic Leverage Understanding:

Use credit to acquire cash-flowing assets, not lifestyle improvements

Leverage other people's money to capture time-sensitive opportunities

Structure debt that properties can service through their own income

Build credit history that opens progressively larger opportunities

Relationship-Based Approach:

Develop lender relationships before needing capital

Create partnership structures that align interests with capital providers

Build track record that demonstrates reliable returns on borrowed capital

Maintain transparency that builds trust for future opportunities

Risk Management:

Never leverage beyond your ability to service debt through property income

Maintain contingency plans for market downturns or vacancy periods

Diversify credit sources to avoid dependency on single lenders

Structure deals that protect both your interests and your lenders' interests

Scalability Focus:

Use credit to build systems that generate increasing returns

Leverage borrowed capital to capture multiple properties in efficient markets

Build credit capacity that grows with business success

Create refinancing strategies that recycle capital for continued growth

Your Quick Win: Calculate your current debt-to-income ratio and identify one credit optimization opportunity that could improve your borrowing capacity.

Want to master the leverage game?

The Component Mastery Reality

Here's what separates STR millionaires from STR strugglers: they identified their strongest component and built their entire business model around it.

They didn't try to be experts in all four areas. They didn't wait until they had mastered every component. They picked their strongest suit and played it relentlessly while partnering or outsourcing everything else.

Knowledge operators become the consultants that money operators hire.

Time operators become the implementers that knowledge operators partner with.

Money operators become the capital sources that time operators leverage.

Credit operators become the deal makers that connect everyone else.

The marketplace rewards depth, not breadth. Your competition isn't trying to master all four components - they're trying to dominate one component so completely that everyone else needs them.

Meanwhile, you're probably trying to be good at everything and ending up great at nothing.

Stop trying to be well-rounded. Start trying to be exceptional at one thing.

The operators hitting $800+ per bedroom consistently aren't the ones who know a little about everything - they're the ones who know everything about their component and partner for the rest.

Which component will you master?

P.S. Ready to identify your strongest component and build your empire around it? I've helped hundreds of operators stop spreading themselves thin and start dominating their natural strengths. Let's strategize and identify exactly which component you should focus on and how to monetize it immediately.

The operators who scale fastest aren't trying to do everything - they're doing one thing better than anyone else in their market.

What's your one thing?

Want more strategies for identifying and monetizing your strongest business component? Join thousands of operators getting focus-driven STR strategies that eliminate overwhelm and accelerate results.