REVEALED: Why Most STR Operators Are Bleeding Money

(And How AI Fixes It)

Here's a shocking truth: The most successful STR operators aren't thinking about real estate at all.

While everyone else is obsessing over cap rates and property features, top performers are focusing on something entirely different - and it's giving them a 15-25% advantage in both occupancy and revenue.

In this edition, we're pulling back the curtain on:

🤖 Why AI is Making Traditional STR Strategies Obsolete

🎯 The Counter-Intuitive Secret of Top Performers

💰 The New Rules of Rental Arbitrage Success

Plus: The exact system helping operators transform cleaning from a cost center into a profit generator...

Here’s what’s fascinating about today’s AI revolution in the STR space…

AI Valuation Models Reshape Property Pricing

Source: Forbes

Takeaway: Automated valuation models (AVMs) now analyze 23+ data points to price properties with 98% accuracy, reducing appraisal time from weeks to minutes.STR Market Growth Accelerates in Emerging Markets

Source: Lighthouse

Takeaway: Asia added 350,000+ STR units in 2024 - a 25% YOY surge - while North American supply growth stabilized at 3% amid regulatory pressures.AI Chatbots Cut Hospitality Labor Costs by 40%

Source: ScrumLaunch

Takeaway: Major chains like Hilton now use AI concierges handling 10,000+ guest queries nightly, reducing front-desk staffing needs while improving response times.Predictive Maintenance Saves 18% in Property Upkeep

Source: Rentastic

Takeaway: Machine learning systems forecast HVAC failures 14 days in advance, slashing emergency repair costs for STR operators.AI Lease Analyzers Prevent 93% of Contract Disputes

Source: LinkedIn

Takeaway: Natural language processing tools review rental agreements in seconds, flagging problematic clauses with 99.7% accuracy.

🏦 Need Capital for Your STR Business?

Transform Your Good Credit into $250K+ in Business Funding

Stop letting capital constraints limit your STR growth. Fund&Grow has helped 30,000+ business owners access over $1.6 Billion in unsecured business credit with:

0% introductory rates

No collateral required

Multiple credit card batches

Credit lines up to $250K

Join thousands of successful STR operators who've scaled their portfolios using Fund&Grow's proven system. 4.9-star rating across 4,000+ reviews.

Special Offer for Cashflow Diary Subscribers

→ Get Your Free Pre-Qualification: [LINK]

The #1 Mistake Killing Your Rental Arbitrage Profits (And How to Fix It)

Recent market analysis shows that a significant percentage of rental arbitrage ventures struggle to achieve profitability in their first year of operation.

This isn't random chance - it reflects a fundamental misunderstanding about what drives success in this business model.

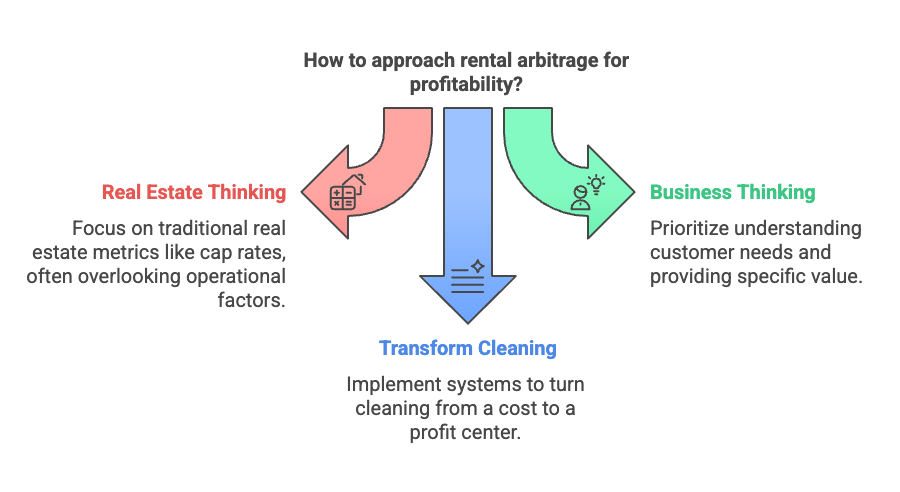

The core issue is that most people approach rental arbitrage like a real estate investment when it's a business operation requiring different strategic thinking.

Industry data consistently shows successful STR operators focus on customer needs before property features, creating a critical advantage in competitive markets.

The Fatal Mistake: Real Estate Thinking vs. Business Thinking

When you treat rental arbitrage like real estate, you prioritize metrics like cap rates, property appreciation potential, and neighborhood prestige above operational factors.

These considerations have their place, but shouldn't drive your primary decision-making process.

Real estate thinking leads to location-first or amenity-first approaches that often miss the most crucial success factor in the STR space.

The key question isn't "Where's the best property?" but "Who exactly needs accommodations in this area, and what specific value can I provide them?"

Transform cleaning from an expense into a profit center with the systems revealed in your complimentary STR Goldmine guide. Learn the exact tracking methods, checklists, and pricing strategies used by top operators to increase margins while maintaining 5-star cleanliness standards.

The Financial Consequences Are Measurable

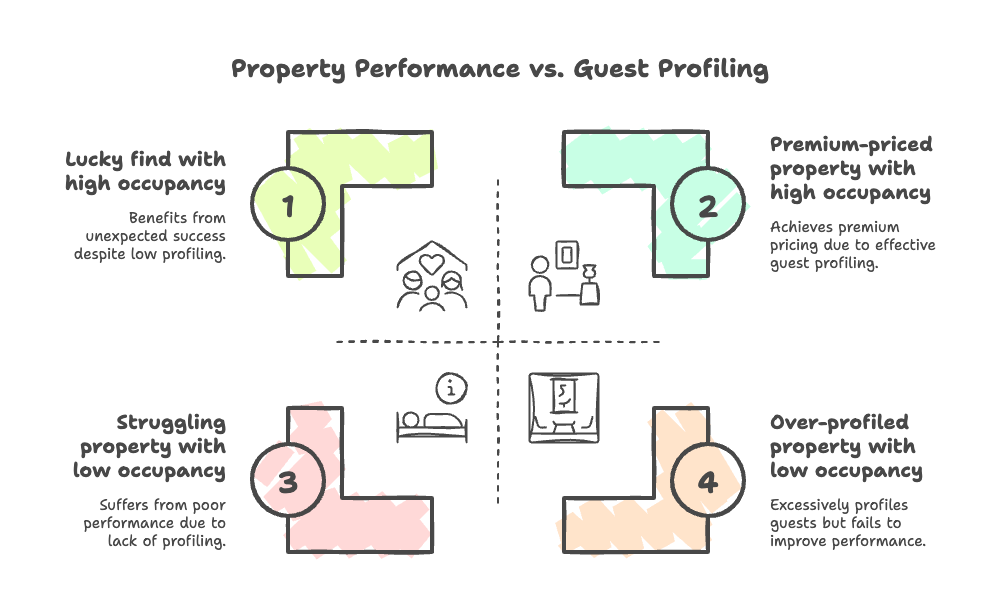

Market research demonstrates that properties selected without a clear target guest profile typically experience lower occupancy rates and reduced average daily rates.

Operational data shows these properties often run 15-20% below optimal performance levels, turning potential profits into consistent losses.

Without a defined target market, pricing becomes reactive rather than strategic, and marketing efforts lack focus - both directly impacting your bottom line.

These financial impacts compound over time, as suboptimal performance can affect one's ability to negotiate favorable lease terms or expand one's portfolio.

The Business Mindset Solution

Top-performing rental arbitrage operators consistently begin with guest profiling before property selection, according to multiple industry benchmarking studies.

STR market analysis shows that properties with clearly defined guest personas maintain higher occupancy rates and command premium pricing compared to generic offerings.

Research indicates that the most successful operators develop detailed guest profiles based on travel purpose, duration patterns, and specific accommodation needs.

This data-driven approach allows for strategic property selection and amenity prioritization that directly addresses verified market demands.

How to Implement This Approach Today

Step 1: Define your ideal guest with extreme specificity based on verifiable travel patterns in your target market. Use demographic and behavioral data to create detailed profiles.

Step 2: Research existing accommodation options serving this guest profile and identify specific service gaps or unmet needs through competitive analysis.

Step 3: Utilize data analysis tools to evaluate market opportunities. Industry platforms provide insights on occupancy rates, pricing trends, and guest preferences in different locations.

This methodical process transforms property selection from intuition-based to data-driven, substantially improving decision quality.

Your complimentary "STR Goldmine" guide attached to this newsletter provides the complete PROFIT Guest Analysis System to help you implement these steps.

Measurable Results From Market-First Thinking

Market analysis from major STR platforms shows that properties aligned with specific guest needs consistently outperform generic accommodations by 15-25% in occupancy and revenue.

Properties targeting defined market segments (such as medical professionals, corporate travelers, or specific event attendees) demonstrate greater resilience during seasonal fluctuations.

The data shows that this isn't about property luxury or location prestige—it's about precise alignment between guest needs and property offerings.

Multiple case studies document how operators focusing on niche markets achieve profitability faster than those attempting to appeal to general audiences.

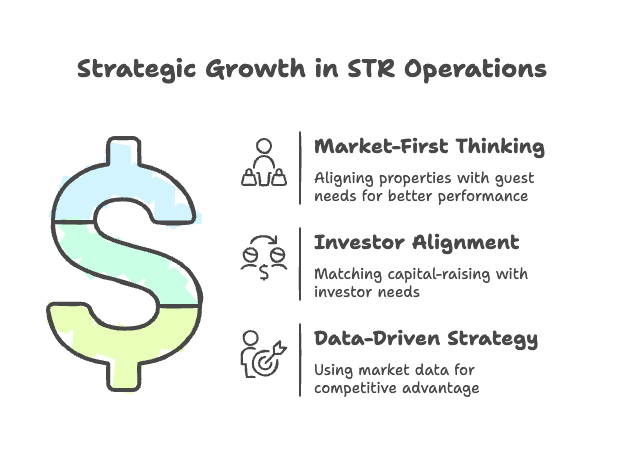

The Advanced Strategy: Investor Alignment

The same business principles that optimize guest targeting can be applied to finding appropriate investment partners for your STR operation.

Market research indicates that investors with specific goals (passive income, portfolio diversification, or hands-on business involvement) respond to different proposition structures.

Aligning your capital raising approach with investor needs follows the same principles as aligning your properties with guest needs - specificity creates value.

Industry data shows that STR businesses with clearly defined operational models attract more suitable investment partners than those presenting generic opportunities.

Ready to master guest targeting and investor acquisition? Our exclusive "Blueprint" course includes proven playbooks for finding your ideal market, guest, property, and investors.

100 spots left (or May 30th) - whichever comes first

What The Data Reveals For Your Strategy

The STR marketplace continues to evolve, with increasing professionalization and competitive pressure requiring more sophisticated business approaches.

Market analysis confirms that property selection should result from your business strategy, not the starting point of your planning process.

Your competitive advantage develops from understanding specific guest needs better than others and structuring your entire operation to meet those needs efficiently.

This strategic shift - from property-first to market-first thinking - represents the fundamental difference between struggling and thriving in today's rental arbitrage landscape.

The question isn't whether rental arbitrage can be profitable - market data clearly shows it can - but whether your approach follows the patterns of successful operators.

Start with verified market needs, then select properties that serve those needs exceptionally well. The data shows this sequence matters.

Transform your STR strategy with AI-enhanced templates, monthly web classes, live Q&A sessions, and exclusive playbooks (a $2,500+ value) designed to eliminate the guesswork from your business.

Next 100 members or May 30th - then it's gone

The most profitable STR operators understand that success begins with identifying whom you serve, not which property you buy.

By implementing a business-first approach, you'll make smarter acquisition decisions, command higher rates, and build a more resilient portfolio.

Your STR journey starts with asking the right question: Who is your ideal guest?

Until next time…

J. Masey

When you're ready, here's how I can help:

Remember: This newsletter delivers actionable STR strategies that others charge thousands for weekly. Your continued readership is your edge in this competitive market.

Join Our Free STR Workshop - Transform your life with our 3-hour workshop on building a lucrative Short-Term Rental portfolio.

Expert insights, actionable strategies, and exclusive offers available only during the live event. [Register Now]

Get $10,000 Per Month Guarantee—Airbnb Hosts & STR Operators with 0-20 units: We'll guarantee an additional $10,000 monthly for five consecutive months through our Done-FOR-You Reservation Growth Model.

…or you DON'T pay AND we'll send you $1994 for wasting your time. [Learn More]

Sponsor This Newsletter - Get your brand in front of thousands of real estate investors and STR operators who are serious about building wealth.

Send mail to: 1691 Forum Drive, Suite B345, West Palm Beach, FL 33401