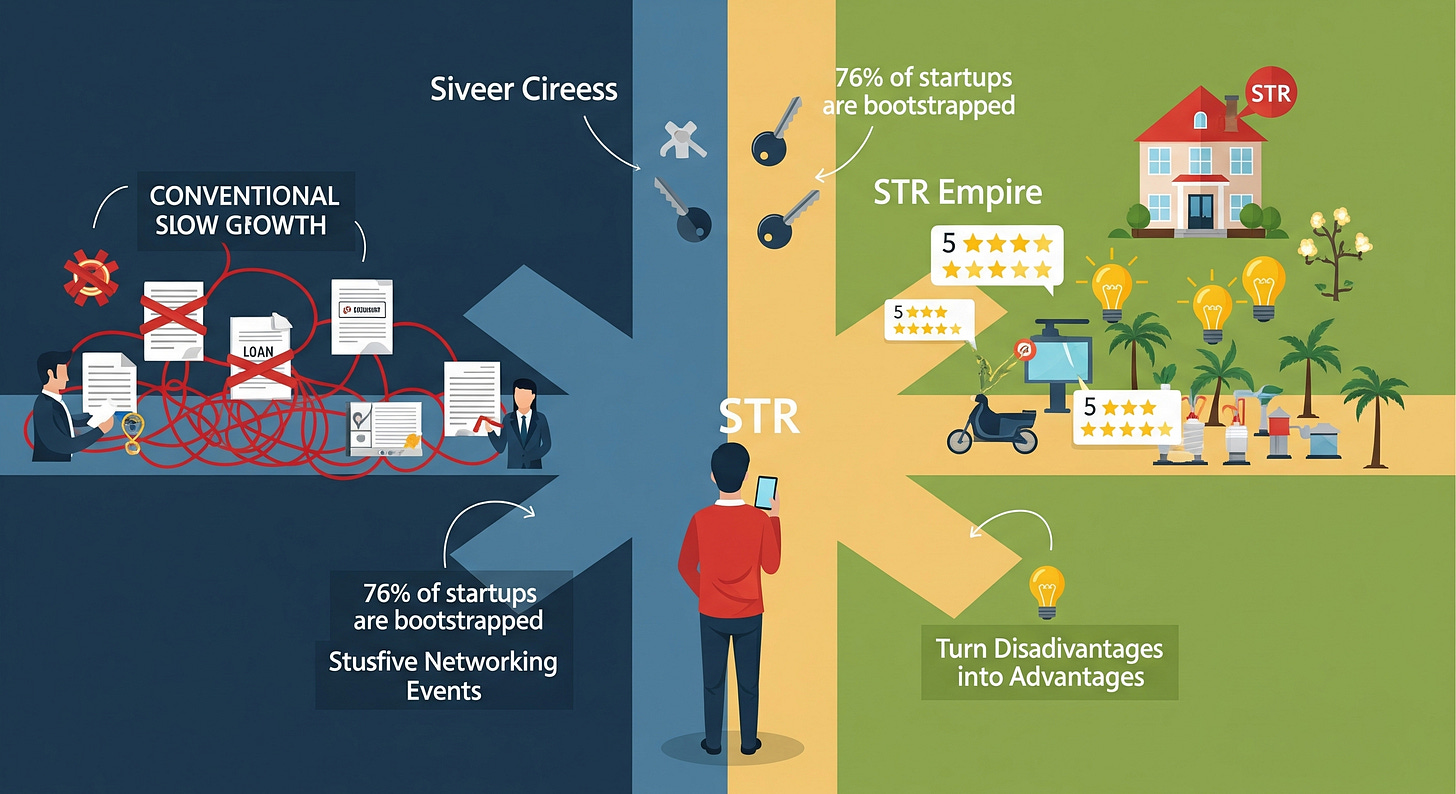

How a 398 Credit Score and Zero Capital Built a Multi-Million Dollar STR Empire (And Why Your 'Perfect' Finances Are Holding You Back)

Why Your Biggest STR 'Disadvantage' is Actually Your Competitive Edge

Table of Contents

Why Rich People Make Terrible STR Operators

The 398 Credit Score Advantage Nobody Talks About

Why Squatting Taught Me More Than Harvard Business School Ever Could

The Brutal Truth: Comfort Kills STR Profits

How to Turn Your Worst Financial Nightmare Into Your Biggest STR Asset

Everyone told me I was too broke to invest in real estate. They were right - and that's exactly why I succeeded.

While my well-funded competitors were analyzing spreadsheets and attending networking events, I was learning the most valuable STR lesson of all: desperate people make desperate moves, and desperate moves create breakthrough results.

You see, when you have no choice but to succeed, you develop skills that money can't buy. When comfort isn't an option, you get comfortable being uncomfortable. And when you're forced to solve problems with creativity instead of capital, you build the exact mindset that creates STR empires.

Today, I'm going to prove that your biggest financial disadvantage is actually your competitive edge. But first, let me tell you about the business credit solution that's helped over 200 of our students secure the capital they need...

Sponsored by Fund & Grow

Speaking of capital challenges - I've been working with Fund & Grow for 4-6+ years because they solve the #1 problem new STR operators face: access to business credit. We've helped our students secure $200K+ in business credit, even when they're brand new to STR.

Unlike traditional lenders who want perfect credit and 2 years of tax returns, Fund & Grow specializes in getting business credit for operators who need capital NOW, not someday. They understand that STR success isn't about perfect financials - it's about execution and results.

Why Rich People Make Terrible STR Operators

Here's what nobody wants to admit: having too much money makes you a worse STR operator, not a better one.

The Jobs to be Done Framework reveals why: when you hire unlimited capital to solve problems, you never learn to hire creativity, resourcefulness, or efficiency. You throw money at challenges instead of developing systems. You buy solutions instead of building skills.

Design Thinking shows us that the best innovations come from constraints, not abundance. When you have every amenity, unlimited renovation budgets, and premium locations, you lose touch with what guests actually value versus what you think they want.

According to research from the Kauffman Foundation, 76% of billion-dollar startups were bootstrapped or received minimal initial funding, proving that resource constraints often drive better business outcomes than abundant capital.

Here's the STR reality: wealthy operators typically create over-engineered properties that serve their egos more than their guests. They focus on luxury amenities that sound impressive but don't drive bookings. They optimize for what impresses other investors rather than what solves guest problems.

Meanwhile, the "broke" operator learns to optimize for actual guest satisfaction metrics: fast WiFi, comfortable beds, spotless cleanliness, and seamless check-in processes. These operators focus on the basics because they can't afford to waste money on non-essentials.

Your Quick Win: Audit your last 5 business decisions - which ones would you have made differently if you had unlimited money? The answers reveal where constraints actually improved your choices.

The 398 Credit Score Advantage Nobody Talks About

My 398 credit score wasn't a limitation - it was the best business education I never paid for.

The Jobs to be Done Framework here is powerful: when traditional financing rejects you, you're forced to hire alternative strategies that wealthy operators never discover. You learn seller financing, subject-to deals, partnership structures, and creative acquisition methods that create competitive advantages money can't buy.

Design Thinking teaches us to develop empathy for our users - and who better understands financial struggle than someone who's lived it? This empathy translates directly into better guest experiences for budget-conscious travelers, who represent the majority of the STR market.

As entrepreneur Sara Blakely, who started Spanx with $5,000, once said:

"I think failure is nothing more than life's way of nudging you that you are off course. My attitude to failure is not attached to outcome, but in not trying. It is liberating."

My credit score forced me to master strategies that are now worth millions:

Creative financing structures that don't require perfect credit

Partnership models that leverage other people's creditworthiness

Cash flow optimization because every dollar had to count

Due diligence skills because I couldn't afford mistakes

These aren't disadvantages - they're unfair advantages disguised as limitations.

Your Quick Win: List 3 STR acquisition strategies that don't require perfect credit. If you can't name them, you're missing opportunities that your financial constraints could have taught you.

Ready to learn the credit-free acquisition strategies?

Why Squatting Taught Me More Than Harvard Business School Ever Could

While MBA students were studying theoretical case studies, I was getting a PhD in real-world property management from the most brutal professor of all: necessity.

The Jobs to be Done Framework reveals the truth: when you hire extreme situations to teach you, you develop skills that classroom learning can't provide. Squatting in a bank-owned property taught me property maintenance, security systems, neighbor relations, and resource optimization at a level no textbook could match.

Design Thinking emphasizes learning through direct user experience. Living in distressed properties gave me unprecedented empathy for what guests notice, what matters for comfort, and what problems need immediate attention versus what can wait.

Research from the Harvard Business Review shows that hands-on experience creates 90% knowledge retention compared to 10% from traditional lectures, demonstrating the power of experiential learning over theoretical education.

This ground-level education created competitive advantages:

Instant problem identification - I can walk through any property and immediately spot issues that would cost guest satisfaction

Cost-effective solutions - I learned to fix problems with creativity instead of capital

Guest psychology understanding - I know what actually matters for comfort versus what property managers think matters

Realistic budgeting - Every expense had to be justified because resources were scarce

The wealthy operators hiring property management companies never develop these instincts. They solve problems with money instead of understanding, creating inefficiencies that compound over time.

Your Quick Win: Spend 30 minutes walking through your worst-performing property as if you were homeless. What would you notice that you've been ignoring? That discomfort will reveal improvement opportunities.

The Brutal Truth: Comfort Kills STR Profits

Here's the uncomfortable reality: every comfort you add to your business removes a competitive edge.

The Jobs to be Done Framework shows us that when you hire comfort to avoid difficult decisions, you simultaneously hire mediocrity. Comfortable operators don't question industry standards, challenge conventional wisdom, or push boundaries that create breakthrough results.

Design Thinking teaches us that breakthrough innovation requires testing uncomfortable assumptions. When you're comfortable with your current performance, you stop experimenting with improvements that could 10x your results.

As Netflix CEO Reed Hastings observed:

"Most entrepreneurial ideas will sound crazy, stupid and uneconomic, and then they'll turn out to be right."

Financial pressure prevented me from making expensive mistakes that comfortable operators routinely make:

Over-renovating properties based on personal taste rather than guest data

Premium location assumptions without validating actual booking demand

Technology overspend on systems that impress operators but don't improve guest experience

Amenity creep that increases costs without proportional revenue increases

According to research from McKinsey & Company, companies operating under resource constraints show 23% higher innovation rates than those with abundant resources, proving that limitation drives creativity.

Meanwhile, my financial constraints forced optimization decisions that created sustainable competitive advantages:

Data-driven decision making because I couldn't afford to guess wrong

Guest feedback obsession because repeat bookings were survival, not luxury

Operational efficiency focus because every inefficiency hit my bottom line immediately

Market timing awareness because I had to catch opportunities when they appeared

Your Quick Win: Identify one "comfortable" business practice you need to challenge this week. The discomfort you feel is probably pointing toward a breakthrough opportunity.

Want to break through your comfort zone?

How to Turn Your Worst Financial Nightmare Into Your Biggest STR Asset

Every financial disadvantage contains a hidden competitive advantage - but only if you know how to extract it.

The Jobs to be Done Framework reveals that financial challenges hire different skills than financial abundance. When you're forced to solve problems with constraints, you develop capabilities that unlimited resources never teach.

Design Thinking shows us how to reframe problems as opportunities. Your financial nightmare isn't a limitation - it's specialized training for a specific market advantage that wealthy competitors can't replicate.

Research from the Global Entrepreneurship Monitor indicates that necessity-driven entrepreneurs show 31% higher survival rates than opportunity-driven entrepreneurs, proving that constraint-based motivation creates more resilient businesses.

Here's how to transform specific financial disadvantages into STR competitive advantages:

Bad Credit → Alternative Financing Mastery

Learn seller financing, subject-to deals, lease options

Master partnership structures that leverage other people's credit

Develop relationships with private lenders who care about deals, not scores

Create acquisition strategies that wealthy operators never discover

Limited Capital → Operational Excellence

Force focus on properties that generate immediate cash flow

Develop efficiency systems that maximize profit per dollar invested

Master guest satisfaction metrics that drive repeat bookings and referrals

Build lean operations that scale without proportional cost increases

No Experience → Market Fresh Perspective

See obvious opportunities that industry veterans overlook

Question "best practices" that may be outdated or market-specific

Develop direct guest relationships instead of relying on industry assumptions

Create innovative solutions unconstrained by "how it's always been done"

Resource Scarcity → Creative Problem Solving

Develop resourcefulness that money can't buy

Learn to identify and leverage underutilized assets

Master the art of maximum impact with minimum investment

Build networks based on mutual value rather than financial positioning

Your Quick Win: Write down your biggest financial failure and identify 3 specific lessons that could improve your STR business today. That failure contains competitive intelligence worth more than any consultant could provide.

Ready to transform your challenges into advantages?

The Reality Check You Need

Your financial disadvantages aren't holding you back - they're the exact training you need to dominate the STR market.

While your well-funded competitors are optimizing for vanity metrics and industry recognition, you're optimizing for the only metrics that matter: guest satisfaction, operational efficiency, and sustainable profitability.

While they're throwing money at problems, you're developing problem-solving skills that compound over time. While they're buying their way into markets, you're earning your place through superior execution and guest experience.

The STR operators who consistently hit $800+ per bedroom targets aren't the ones with the most money - they're the ones with the best systems, strongest guest relationships, and most efficient operations. These advantages come from constraint-based learning, not capital-based acquisition.

Your disadvantages taught you advantages that money can't buy. Now it's time to leverage them.

P.S. If you're ready to turn your disadvantages into your competitive edge, let's talk strategy. I've helped hundreds of operators transform their constraints into competitive advantages. Book your session and let's identify exactly how your specific challenges can become your unique market position.

The operators who dominate markets aren't the ones who started with advantages - they're the ones who turned their disadvantages into unfair advantages that competitors can't replicate.

What disadvantage will you transform into your competitive edge?

Want more strategies for turning constraints into competitive advantages? Join thousands of operators getting unconventional STR strategies that the "experts" won't teach you.